IV. THE EXERGY VALUATION MODEL

From Time to Exergy: A Physics-Based Currency and Bitcoin as the Bridge Protocol

Why Money Fails

This is the fundamental question of economics. Why reinvent the wheel? Why not just stick with the Dollar, the Euro, or Bitcoin? The answer lies in the 'Map vs. Territory' problem. In a pre-automation world, Money (The Map) was a decent proxy for Work (The Territory). Because human effort was scarce and energy was expensive, the price of a good roughly reflected the difficulty of making it.

In a Liquid Labor (Robotic) economy, that link breaks. Money stops measuring reality. Here is the Quantitative argument for why Money fails and Exergy succeeds in a post-labor civilization.

I. The "Divide by Zero" Error (Deflationary Collapse)

Money is designed to measure value in an environment of Scarcity.

- The Logic of Money: "I pay you because it was hard for you to do this."

- The Reality of Robots: It is not hard for them. The marginal cost of production approaches the cost of electricity (≈ 0 relative to human wages).

The Trap: If robots make housing, food, and transport 99% cheaper, Prices (P) collapse.

If P → 0, Nominal GDP collapses.

- In a Money System: A collapsing GDP looks like a Great Depression. Central Banks will print vast amounts of money to "stabilize prices" (inflation), causing money to lose its value.

- In an Exergy System: This system measures the "Quantity of Energy/Matter transformed." Even if the "price" is zero, the "Exergy Value" remains high, indicating abundance rather than depression.

Verdict: Money reacts with panic to abundance, while Exergy provides an accurate measure.

II. The "Printer" Problem (Debasement of money vs. Thermodynamics)

A "yardstick that changes length every year" cannot be trusted.

- Fiat Money: Can be printed infinitely. Policies like Quantitative Easing (QE) or stimulus distort its signal.

- Exergy (Joules): Cannot be printed; it must be generated, implying a physical constraint.

The Space Age Failure

Why did we stop going to the Moon? Because we paid for it in Money.

- As we printed money to pay for welfare/war in the 1970s, the "cost" of Apollo skyrocketed (Inflation).

- If we had priced Apollo in Exergy (Joules), the cost would have remained constant (or fallen as tech improved).

Verdict: Money allows society to lie to itself about what it can afford. Physics (Exergy) forces honesty.

III. The Physics-Based Currency: From Time to Exergy

A common objection is that “time” already measures labor. The key issue is that clock time is a sloppy proxy. A robot sitting idle for one hour and a robot lifting steel beams for one hour both “cost” one hour of time, but their Thermodynamic Cost is vastly different.

I. The Flaw: Why "Clock Time" is a Fake Metric

Human Economy: Time works as a metric because human biological energy output is roughly constant (≈ 100 Watts). One hour of a human digging a ditch is a predictable caloric burn.

Robotic Economy: Output is variable.

- Robot A (Micro-assembler): Consumes 50 Watts.

- Robot B (Heavy Lifter): Consumes 5,000 Watts.

Arbitrage Opportunity: Pricing both robots at "1 Hour" creates an arbitrage opportunity that destroys the economy. A "Hedonist" rents 1,000 Heavy Lifters for the same "Time Price" as 1,000 Micro-assemblers, bankrupting the energy grid.

The Correction: We must convert "Time" into "Thermodynamic Work."

II. The Superior Metric: The "Exergy-Hour" (X)

We stop counting "Seconds." We start counting Exergy (Useful Energy available to do work).

The Governing Equation of Value (V): Instead of V = Wage × Time, the value of any good or service is the sum of the Energy used to create it and the Matter degraded in the process.

P(t) = Power (kW) - Energyδwear(t) · M = Material Entropy

Where:

- P(t): The instantaneous power draw (Energy).

- δwear: The depreciation rate of the robot (Matter). Every time a robot moves a joint, it loses microscopic amounts of steel/lubricant (Entropy).

- M: The replacement cost of the machine (Capital Stock).

The New Unit: 1 X (Exergy Unit) = The economic value of 1 kWh of Energy applied through High-Precision Actuation.

III. Pricing "Matter" as "Frozen Energy"

One might ask whether this framework prices in materials. It does. In this framework, we treat Matter as Frozen Energy.

- Building a steel beam requires Iron Ore + Energy.

- Producing the Iron Ore requires Mining Robot Time + Energy.

The Recursion: Ultimately, the cost of every physical object tracks back to the Energy required to extract, refine, and shape it.

Price of a House: Not determined by "Real Estate Market Dynamics" (speculation), but by the Sum of Exergy (X) required to mine the concrete, smelt the steel, and assemble the bricks.

IV. The "Thermodynamic Yield" Curve

How does this affect the Architect vs. the Hedonist?

We introduce a Scalar of Complexity (Ω). Not all Joules are equal. A Joule used to heat a swimming pool (High Entropy) is worth less than a Joule used to compute a Fusion reaction (Low Entropy).

The Pricing Modifier:

Where:

- Ω ≈ 0 (Heat/Motion): Heating, basic transport. Cheap.

- Ω > 1 (Intelligence/Precision): Nanomanufacturing, AI training, Surgery. Expensive.

The Result:

- The Hedonist: Wants to heat their pool. Ω is low. The price is just raw energy.

- The Architect: Wants to build a Quantum Computer. Ω is high. The price is higher because they are consuming "Computational Order," not just electricity.

V. The Post-Time Definition

Redefines "Time" not as the ticking of a clock, but as "The Rate of Entropy Reversal."

The Definition: Currency is a claim on Negentropy. It measures the capacity to impose Order (Goods/Services) on Chaos (Raw Materials) using Energy.

How to communicate this: Don't tell people "We tax your energy," but rather "We price the Universe accurately."

- Old World (Money): Price was a guess based on supply/demand and speculation.

- New World (Exergy): Price is a physical fact, the exact amount of Energy and Matter required to exist.

This creates a “Physics-Based Currency” that cannot be debased by printing money, because Joules cannot be printed.

IV. Bitcoin: The Bridge Protocol

This is the critical intersection of Thermodynamics and Finance. In the 'Liquid Labor' framework, Bitcoin is not just 'digital gold.' It is the first crude prototype of an Exergy Currency.

While fiat money is based on Authority (government decree), and the Exergy Standard is based on Physics (Joules), Bitcoin acts as the Bridge Protocol. It is 'Proof of Energy.' Here is a deeper dive of where Bitcoin fits in the Time Bank economy.

Source: Capriole Investments Limited. Why it matters: Tracks Bitcoin’s price against energy expenditure—illustrates the thesis that BTC value is tied to proof-of-work (physics), not fiat authority.

I. Bitcoin as "Frozen Energy" (The Physics Link)

The key issue is why we don’t just use money. In this thesis, money is a “fake map” because it can be printed costlessly. Bitcoin solves the “Printer Problem” by tying currency creation directly to Physics through Proof-of-Work (PoW).

- The Mechanism: Minting a Bitcoin requires “burning” Energy (Joules) and computing SHA-256 hashes (Information).

- The Result: A Bitcoin is a “Battery of Value,” representing a verifiable expenditure of past energy.

- The Alignment: Bitcoin is the “Native Currency of the Exergy Standard,” the only asset class that respects the laws of thermodynamics (it cannot be created out of thin air; work must be performed).

Verdict: In a robot-run society (where robots run on energy), the currency must be energy-derivative. Bitcoin is the first successful implementation of this.

II. The Deflationary Hedge (The "Jeff Booth" Thesis)

The thesis predicts massive Deflation (Technological Abundance).

- Fiat Reality: In a deflationary world, Central Banks panic and print money to force inflation, which "steals your purchasing power to subsidize the debt system."

- Bitcoin Reality: Bitcoin has a fixed supply cap (21M) and cannot be inflated.

- If robots make housing/food 50% cheaper, holding Bitcoin doubles purchasing power.

- Bitcoin allows holders to capture the Efficiency Dividend of the robots.

The Role: Bitcoin acts as the "Equity of the Machine Age," a bet that the cost of the physical world will collapse against a fixed mathematical constant.

III. The Currency of Autonomous Agents (M2M Economy)

Robots do not have bank accounts. They cannot pass KYC (Know Your Customer) checks at JPMorgan.

- The Friction: If a delivery drone needs to pay a charging station for electricity, it cannot use a credit card.

- The Solution: Bitcoin (and the Lightning Network) or Solana allows for Trustless Micropayments.

The Liquid Labor Flow:

- Robot A performs a task (Liquid Labor).

- Robot A gets paid in Satoshis (Streaming Money).

- Robot A pays for its own Energy (Exergy) in Satoshis.

Because Bitcoin is purely code, it is the only currency compatible with a fully automated, Machine-to-Machine (M2M) economy. It allows the Time Bank to operate without human bankers.

IV. The "Energy Wall" Synergies

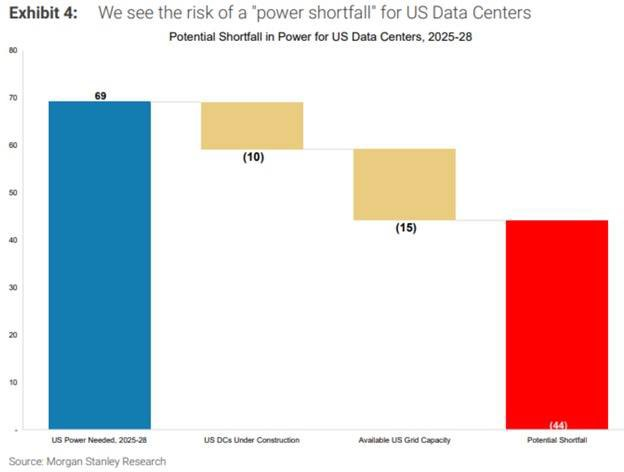

Source: Morgan Stanley research; summary via Jen Zhou (X). Why it matters: US data centers face a ~44GW power shortfall (2025–28); grids cannot fill the gap. Supports the “Energy Wall” and the role of Bitcoin miners as buyers of last resort for stranded energy.

Critically, Bitcoin solves a major problem for the Architect (Energy Infrastructure).

- The Problem: Building massive power plants (for Space/Industry) is risky. If demand dips, the operator loses money. This is the “Stranded Energy” problem.

- The Bitcoin Fix: Bitcoin miners act as the 'Buyer of Last Resort' for energy.

- If the grid has surplus power (e.g., sunny day, low industrial load), miners buy it instantly to hash.

- This sets a Price Floor for energy, making it profitable to build massive 100-Terawatt grids that the Architect needs for the space program.

The Symbiosis: Bitcoin effectively subsidizes the construction of the energy grid required for the Robotic Era.

The "Truth Layer"

In the Exergy Standard, we need a ledger that cannot be lied to.

- Fiat: A ledger managed by politicians (Subjective).

- Bitcoin: A ledger managed by physics (Objective).

"Bitcoin is the Reserve Asset of the Exergy Economy. It proves that work was done (Energy spent)."

In this thesis, Bitcoin is positioned not as a “crypto speculative asset,” but as the “Native Protocol for Liquid Labor.”

- It creates a hard unit of account that measures the deflation robots create.

- It allows robots to own money (M2M payments).

- It monetizes the Energy Surplus needed to build the grid.

Bitcoin is the bank vault; Robots are the depositors; Energy is the currency.