Perfect Elasticity of Labor

Why the 'Lump of Labor' Fallacy Fails in the Age of Perfect Substitution

I. A Skeptic’s View

The "Lump of Labor Fallacy" is the standard defense economists invoke during every technological revolution. A skeptic would argue: "Robots make production cheaper. Prices fall. Consumers buy more. New demand creates new jobs. Human employment stays stable." This is the Scale Effect and it has been historically accurate. ATMs didn't eliminate bank tellers; they expanded banking services. Power looms didn't destroy the textile industry; they made clothing affordable for millions.

The Liquid Labor thesis argues that we are crossing a mathematical threshold: we are moving from an era where machines were Complements (tools) to an era where they are Substitutes (agents). This essay presents the econometric proof that the Scale Effect can no longer save human labor once the Elasticity of Substitution (σ) exceeds the Elasticity of Demand (η).

It is no longer a question of tools augmenting labor; perfect replacement of human labor is now possible in many tasks—general-purpose humanoids and AI agents can substitute for workers at scale.

Loading embed…

View on XLoading embed…

View on XII. The Trap: The Race Between Scale and Substitution

The core question is whether the Scale Effect (consumption growth) can outpace the Substitution Effect (robot replacement). This depends on the relative magnitudes of two elasticities:

- σ (Sigma): Elasticity of Substitution between human and robot labor

- η (Eta): Price Elasticity of Demand for output

III. The Mathematical Framework

III.i The Production Function

Total output Y is produced by tasks (i) performed by either humans (h) or robots (r):

where σ is the Elasticity of Substitution between tasks.

III.ii The Cost Function (The "Price" of Production)

The marginal cost of producing one unit of output (P) is determined by the lower cost input:

Where:

- w: Human Wage

- r: Robot Cost (Liquid Labor Price)

- θ: Share of tasks automated (The Automation Index)

III.iii The Demand for Labor (L^D)

A Skeptic would argue that as P falls, demand for Output Y rises (Y = P-η). This increases demand for labor.

Derived Demand for Human Labor:

Substituting Y (Demand) into the equation yields:

Where:

- (1 - θ): Displacement Effect

- Pσ-η: Productivity Effect

III.iv The Proof Condition

The impact of automation (θ) on Human Labor (L^D) depends on the sign of (σ , η).

- Condition 1: If σ < η: The drop in Price (P) drives massive consumption. Labor demand Rises. (The Skeptic wins).

- Condition 2: If σ > η: The robots substitute for humans faster than consumption grows. Labor demand Falls. (Liquid Labor wins).

IV. The Scenario Analysis (The 3 Phases)

Scenario A: The "Drill Press" Era (1950s - 2000s)

- Technology: Robots are "dumb tools" (Complements). σ = 0.5 (Low substitution).

- Consumption: We are hungry for goods. η = 2.0 (High elasticity).

- The Math: Since σ < η (0.5 < 2.0), the Productivity Effect dominates.

- Result: Automation makes cars cheaper → We buy 3× more cars → We hire more humans to run the machines.

- Chart Dynamics: Demand Curve shifts RIGHT. Supply Curve (Human) is upward sloping. Wages Rise.

Scenario B: The "Substitution" Era (2024 - 2028)

- Technology: Humanoids/AI are "Substitutes". σ → 2.5 (High substitution).

- Consumption: Moderate satiation. η = 1.5.

- The Math: Now σ > η (2.5 > 1.5), meaning the Substitution Effect overwhelms the Scale Effect.

- Result: Consumers buy more goods, but robots capture "more than 100% of the new labor demand."

- Chart Dynamics: Demand for Output shifts Right, but Demand for Human Labor shifts LEFT. Wages Stagnate.

Scenario C: The Ceiling (2030+)

The Trap: The Skeptic's argument fails mathematically even if demand explodes.

Assumption: Assume the Skeptic is right and demand is infinite (η → ∞). Demand for labor shifts massively RIGHT (D₁ → D₂ → D₃).

The Supply Constraint:

- Human Supply (S_H) intersects Demand at $30/hr.

- Robot Supply (S_R) intersects Demand at $3/hr.

The Equilibrium: The market clears at the "lowest marginal price."

Result: Even if billions of labor hours are needed, the wage will never exceed the cost of the robot (r). Since humans cannot live on $3/hr, "Human Employment falls to zero" (or retreats to niche luxury services).

V. The Theorem of the "Kinked" Supply Curve

The core argument is about Supply, not demand.

Human Labor Supply (S_H)

- Upward sloping

- Inelastic in the short run

- Requires higher wages for more humans (opportunity cost, leisure preference)

Liquid Labor Supply (S_R)

- Horizontal

- Perfectly Elastic

- Robots can be manufactured at a constant marginal cost (Energy + Amortized CapEx)

The Combined Supply Curve (S_Total)

This curve is "Kinked":

- Zone 1 (Human Domain): At low quantities, human labor is cheaper than robots. The curve slopes up.

- Zone 2 (The Robot Ceiling): Once wages hit the cost of automation (w* = C_robot), the supply curve becomes flat (horizontal) to infinity.

We will prove that once Demand crosses into Zone 2, the "Scale Effect" (consuming more goods) no longer benefits human wages.

VI. Econometric Specification (The "Test")

To verify this empirically (or to pose it to an economist), one would run the following regression on sector-level data (Manufacturing, Logistics):

Where:

- Lit: Human hours worked

- Yit: Sector Output (The Scale Effect)

- w/r: Wage-to-Robot-Cost Ratio (The Substitution Effect)

The Hypothesis Test

- Skeptic's Null Hypothesis (H₀): β₁ (Scale) is positive and large enough to offset substitution.

- Liquid Labor Alternate Hypothesis (H₁): As r (robot cost) falls, the σ term (substitution) becomes the dominant predictor, decoupling L from Y.

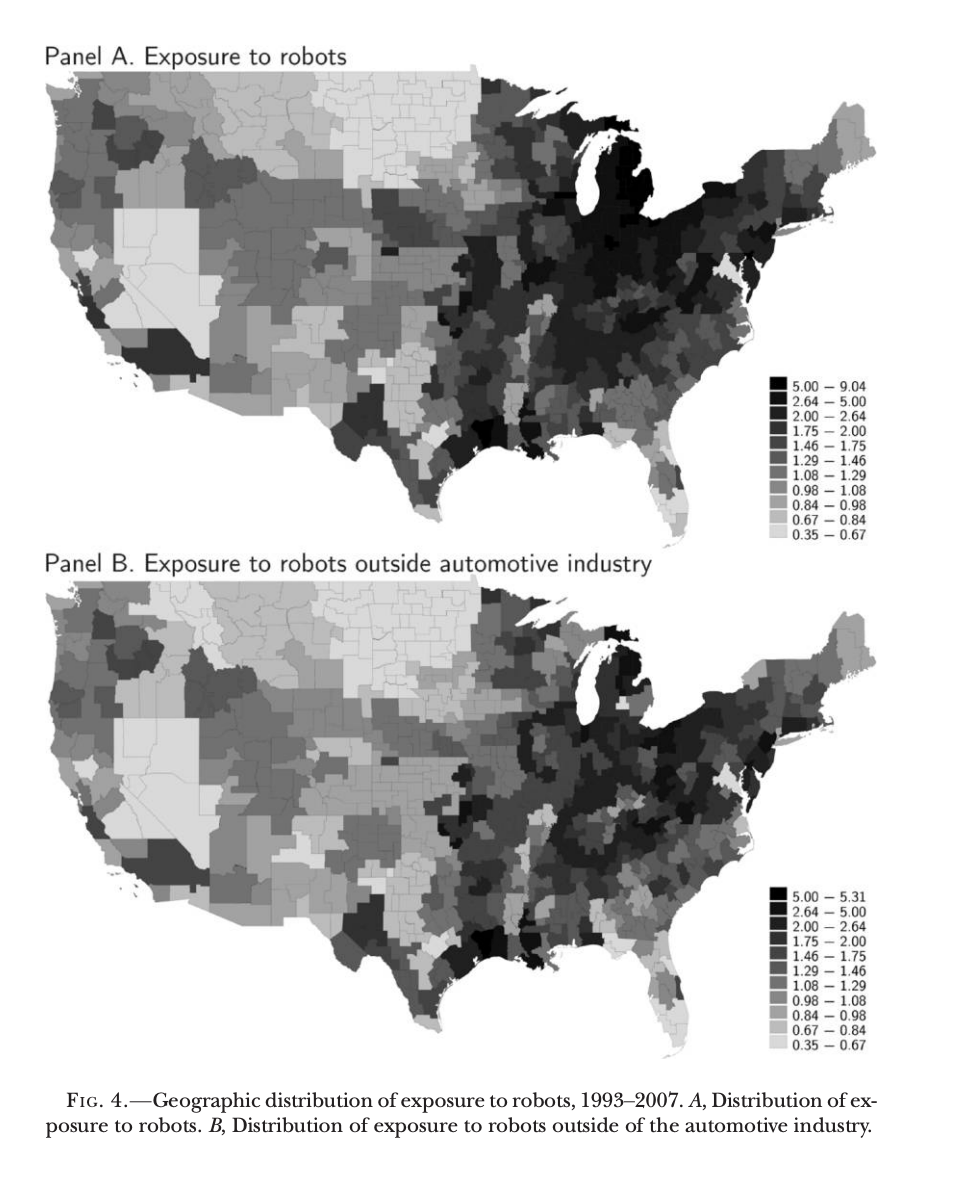

Recent Data (Acemoglu/Restrepo)

Source: Acemoglu & Restrepo (2020), “Robots and Jobs: Evidence from US Labor Markets,” paper. Why it matters: Empirical evidence that robot exposure reduced employment and wages (coefficient ≈ -0.34); for every one robot per 1,000 workers, employment-to-population dropped ~0.2 pp and wages fell 0.42%. Supports the thesis that scale effects can fail to compensate for displacement.

Finding: In US Manufacturing (1990-2007), the coefficient for robotics impact on employment was negative (-0.34) (Acemoglu & Restrepo, 2020).

Implication: This suggests we have already mathematically crossed the threshold where Scale effects fail to compensate for Displacement.

Thesis

- Skeptic's View: "The Skeptic is assuming we are in Scenario A (Complements), where σ < η."

- Liquid Labor's Counter-Argument: "The math of Liquid Labor proves that once we reach General Purpose Robotics, σ exceeds η."

- Further Critique: "Furthermore, they are ignoring the Supply Curve Geometry. Even if demand explodes (Scale Effect), the Perfectly Elastic Supply of robots creates a price ceiling (w = C_robot). In that geometry, infinite demand does not raise wages; it just prints more robots."

The Scale Effect, the idea that automation lowers costs, driving up demand (since we aren't at 'peak consumption'), which recycles labor into new roles. That has held true for 200 years because machinery was a complement to labor (σ < 1).

We argue:

- Elasticity of Substitution (σ): General-purpose humanoids push σ above 1. When capital becomes a near-perfect substitute for labor, the Substitution Effect mathematically overwhelms the Scale Effect. Even if consumption creates new demand, robots capture 100% of that marginal growth.

- Labor Elasticity: The issue isn't that human supply is inelastic; it's that Robotic Supply is perfectly elastic. If a robot costs $3/hour to run and can be printed on demand, it creates a hard price ceiling. Human labor supply can be as elastic as it wants, but it cannot clear the market below the cost of energy + compute."

So, we don't assume fixed production (lump of labor). We assume that Marginal Output decouples from Marginal Human Input once σ > η.

IX. Historical Evidence: The "Peak Horse" Warning

The skeptic claims that "Scale" always saves the worker. History provides a counter-example where it didn't: The Horse.

In 1900, horses were the backbone of the economy. When the internal combustion engine arrived, it made transport cheaper. Demand for transport exploded (Scale Effect). We moved more goods than ever before.

- Did this employ more horses? No. The horse population peaked in 1915 and then collapsed.

- Why? Because the engine was a Substitute (σ > 1), not a complement. It offered Perfectly Elastic Supply (we could build engines faster than we could breed horses).

The "Lump of Labor" fallacy was true for humans in the 20th century only because we were the operators of the machines. In the 21st century, when the machine becomes the operator, humans become the horse.

X. Policy Conclusion: The Decoupling

We are not betting against technology. We are betting on technology. Specifically, we are betting that the Substitution Coefficient (σ) of embodied AI is rising faster than the Demand Elasticity (η) of the global economy.

The Policy Axiom:

"When the supply of labor becomes liquid (manufactured), the link between GDP Growth and Wage Growth is severed."

We do not need to assume "peak consumption." We can assume infinite consumption. But in a world of high-σ Liquid Labor, infinite consumption will simply result in infinite robots, not infinite jobs.

This is why the Liquid Labor framework is not a recessionary prediction, it is a prediction of Hyper-Productivity coupled with Labor Displacement. The pie gets larger, but the slice going to labor gets smaller. That is the definition of the Scale Effect Trap.

XI. The Supply Curve Geometry: Why Wages Cannot Adjust

The skeptic suggests humans are 'elastic' that workers will simply accept lower wages or shift industries to stay employed. This misses the most dangerous feature of Liquid Labor: Perfectly Elastic Supply.

Human labor supply is Inelastic (upward sloping). We need sleep, food, and incentives. We cannot be printed on a factory line. Liquid Labor supply is Perfectly Elastic (horizontal). Robots can be manufactured at a constant marginal cost (MC = Energy + Amortized CapEx).

The "Kinked" Supply Theorem

The labor market now faces a 'Kinked' supply curve.

- Zone 1 (Human Domain): At low volumes, humans are cheaper than robots. Wages rise with demand.

- Zone 2 (The Robot Ceiling): Once the prevailing wage hits the Cost of Automation (Crobot), the supply curve becomes flat.

Mathematical Consequence:

If a humanoid robot operates for $3/hour (energy + depreciation), this creates a hard price ceiling. It does not matter how 'elastic' the human workforce is; humans cannot biologically sustain themselves below the subsistence wage.

Demand Curve shifts right (due to the Scale Effect), but because it intersects the horizontal line, Quantity increases (more robots) while Wages remain flat.

ADDENDUM: THE PSYCHOLOGY OF ELASTICITY

The Divergent Fates of the Ascetic vs. The Hedonist

This is a profound extension of the thesis. We have identified that Price Elasticity of Demand (η) is not a universal constant, but a variable dependent on human psychology.

By distinguishing between Ascetics (Low η) and Hedonists (High η), we uncover a bifurcation in how the Scale Effect Trap plays out. The 'Substitution Effect' punishes them in diametrically opposite ways.

I. The Variable η: Defining the Personas

In our governing equation, the ability of the economy to re-absorb human labor depends on (η , 1), where η is the willingness to consume more when prices fall.

(η , 1) = Scale Effect(σ , 1) = Substitution Effect

We must model two distinct agents:

Agent A: The Ascetic (The Satiation Agent)

- Definition: An agent with fixed needs (food, shelter, basic comfort). Once these are met, their marginal utility of consumption drops to zero.

- Econometrics: η → 0. (Inelastic Demand).

- Behavior: If automation makes housing 50% cheaper, they do not buy a second house. They simply work 50% less. They bank Time, not goods.

Agent B: The Hedonist (The Insatiable Agent)

- Definition: An agent with infinite desires. Lower prices simply unlock new tiers of consumption (better travel, digital goods, status signals).

- Econometrics: η → ∞. (Perfectly Elastic Demand).

- Behavior: If automation makes goods 50% cheaper, they consume 2× (or 3×) more. They chase Output, not time.

II. The Ascetic Scenario: The "Deflationary Exit"

For the Ascetic, the Scale Effect (η , 1) is negative.

The Economic Consequence: For this population, automation immediately destroys labor demand, regardless of how good the robots are (σ). Even "dumb" automation kills jobs here because the Ascetic refuses to consume enough to create new work.

- The Trap: They effectively shrink the GDP (in nominal terms). A society of Ascetics triggers a "Secular Stagnation" where prices and wages both collapse.

- The Advantage: They are the primary beneficiaries of the Liquid Labor ecosystem.

- Since they do not chase status goods (which remain scarce/expensive), their "personal inflation rate" falls alongside the cost of robotic production.

- They "exit" the labor force voluntarily. The Time Bank works perfectly for them: they trade their labor for autonomous output and retire early.

Verdict: The Ascetic destroys GDP but maximizes personal Standard of Living.

III. The Hedonist Scenario: The "Red Queen" Race

For the Hedonist, the Scale Effect (η , 1) is massive.

This is the group the Skeptic relies on to "save the economy." They will buy the new flying cars, the VR experiences, and the hyper-customized goods.

The Economic Consequence: Because their demand is infinite, they keep the economy growing. However, this is where the Substitution Effect (σ) bites them hardest.

- The Trap: To satisfy their infinite demand, they need income. But as robots become perfect substitutes (σ > η), the "Robot Ceiling" caps their wages at $3/hour.

- The Paradox: The Hedonist is surrounded by cheap abundance (thanks to robots) but suffers from "Relative Poverty." They want the new scarce goods (human attention, prime real estate, status), but they cannot earn enough labor income to compete for them.

- The Red Queen Effect: They must run faster just to stay in place. They are forced into hyper-competitive "Human Niche" jobs (influencers, empathy workers, high-stakes decisions) where σ is still low, just to fund their consumption habits.

Verdict: The Hedonist maximizes GDP but suffers from maximum Wage Displacement Anxiety.

IV. Mathematical Synthesis: The Bifurcation

Chart Logic:

- X-Axis: Automation Level (θ).

- Y-Axis: Human Well-being (Utility).

- Line 1 (Ascetic): Rises as Automation increases. Costs fall, and they need less income. They achieve "Post-Labor" bliss quickly.

- Line 2 (Hedonist): Initially rises (cheap goods), then Crashes. As σ passes the threshold, their wage income collapses, but their desire for consumption remains infinite. The gap between "What I want" and "What I can earn" widens catastrophically.

V. The Policy Implications for Policy Makers

The substitution effect has radically different political consequences for these two groups:

- For Ascetics (The "Quiet Quitting" Class): The risk is Tax Base Erosion. They will stop working, live cheaply on robotic outputs, and stop paying income tax. The state loses revenue.

- For Hedonists (The "Hustle" Class): The risk is Political Instability. They are the ones who will find themselves running on a treadmill that robots are spinning faster than human legs can move.

THE ARCHITECT-HEDONIST-ASCETIC RELATIONSHIP

Scientists and Engineers occupy a unique third category. They are distinct from the Ascetic (who withdraws) and the Hedonist (who consumes). We classify them as The Architects.

Historically and psychologically, they often exhibit Personal Asceticism (Einstein's wardrobe, the Silicon Valley hoodie) but Resource Hedonism (insatiable demand for compute, energy, and lab equipment).

I. The Persona: The Architect (The High-Fixed-Cost Agent)

Scientists and Engineers are not driven by the marginal utility of consumer goods. They are driven by the marginal utility of Discovery and Capability.

- Utility Function (UArch): They maximize problem-solving capacity.

- The Constraint: Discovery has massive Fixed Costs (F).

- Training GPT-5 costs billions.

- Building a particle collider costs billions.

- Developing a humanoid robot stack costs years of burn.

The Paradox: The Architect wants to drive the marginal cost of production to zero (efficiency), but they need massive aggregated capital to do it.

II. The Mathematical Relationship: The R&D Sustainability Condition

Why can't a society of just Engineers and Ascetics work? Why do we need the Hedonist buying useless digital skins or fast fashion?

The Proof: Let the income of the Scientist (IArch) be a fraction (λ) of Total Revenue (TR) generated by the economy. This is the R&D budget.

Total Revenue is Price (P) times Quantity Sold (Y).

We know from our Liquid Labor model that automation drives Price (P) down.

We substitute the Demand Function (Y = P-η) into the Revenue equation:

Now, let's analyze the derivative of the Scientist's income as technology improves (as P falls):

Case A: The "Ascetic World" (η < 1)

- The Ascetic has low demand elasticity. As prices drop, they buy the same amount and bank the savings.

- The Math: If η < 1, then (1 , η) is positive.

- The Result: As P falls (automation succeeds), Total Revenue Falls.

- Consequence for the Scientist: The R&D budget collapses. The economy enters a deflationary spiral. There is no surplus capital to buy the GPUs, build the colliders, or fund the Mars mission.

- A society of Ascetics starves its Scientists.

Case B: The "Hedonist World" (η > 1)

- The Hedonist has high demand elasticity. As prices drop, they gorge on consumption (VR, travel, services).

- The Math: If η > 1, then (1 , η) is negative (inverse relationship).

- The Result: As P falls, Total Revenue Rises (Quantity explodes faster than Price drops).

- Consequence for the Scientist: The "Volume" of the Hedonist's consumption aggregates tiny margins on billions of units into a massive surplus. This surplus funds the Scientist's next project.

III. The Symbiotic Loop

This establishes a fundamental Trophic Cascade in the automated economy.

- The Architect (Engineer) creates Liquid Labor (Robots).

- Goal: Efficiency (P → 0).

- The Robot produces abundance.

- Resulting Deflation.

- The Hedonist (Consumer) provides the Scale (η).

- Function: They act as the "waste heat sink" or the "demand sponge." By irrationally consuming way more than they need, they keep Total Revenue (TR) high.

- The Surplus flows back to the Architect.

- Outcome: Funding for the next level of technology (Atech).

IV. Summary of the Thesis

The Engineer is a parasite on the Hedonist's desires.

- The Engineer despises inefficiency, yet they require the Hedonist's inefficiency (insatiable desire) to fund their work.

- If the Hedonists decided to become Ascetics (stop buying new iPhones, stop using VR, live simply), the Volume of the economy would crash.

- Without Volume, the fractional tax (λ) that funds Science evaporates.

Engineers fall into the Architect bucket. They act as the supply-side engine (σ → ∞). However, they are mathematically dependent on the Hedonist. The Engineer needs high Aggregate Demand to amortize the massive fixed costs of high-tech infrastructure (the 'Scale Effect'). If the population consisted only of Ascetics (η < 1), automation would cause Revenue to collapse to zero (Deflationary Death Spiral), starving the Engineers of capital. The Hedonist's role is to consume the surplus volume, keeping the 'Revenue' variable high enough to fund the next generation of Science.

WHY MONEY FAILS: THE EXERGY STANDARD

This is the fundamental question of economics. Why reinvent the wheel? Why not just stick with the Dollar, the Euro, or Bitcoin? The answer lies in the 'Map vs. Territory' problem. In a pre-automation world, Money (The Map) was a decent proxy for Work (The Territory). Because human effort was scarce and energy was expensive, the price of a good roughly reflected the difficulty of making it.

In a Liquid Labor (Robotic) economy, that link breaks. Money stops measuring reality. Here is the Quantitative argument for why Money fails and Exergy succeeds in a post-labor civilization.

I. The "Divide by Zero" Error (Deflationary Collapse)

Money is designed to measure value in an environment of Scarcity.

- The Logic of Money: "I pay you because it was hard for you to do this."

- The Reality of Robots: It is not hard for them. The marginal cost of production approaches the cost of electricity (≈ 0 relative to human wages).

The Trap: If robots make housing, food, and transport 99% cheaper, Prices (P) collapse.

If P → 0, Nominal GDP collapses.

- In a Money System: A collapsing GDP looks like a Great Depression. Central Banks will print vast amounts of money to "stabilize prices" (inflation), causing money to lose its value.

- In an Exergy System: This system measures the "Quantity of Energy/Matter transformed." Even if the "price" is zero, the "Exergy Value" remains high, indicating abundance rather than depression.

Verdict: Money reacts with panic to abundance, while Exergy provides an accurate measure.

II. The "Printer" Problem (Debasement of money vs. Thermodynamics)

A "yardstick that changes length every year" cannot be trusted.

- Fiat Money: Can be printed infinitely. Policies like Quantitative Easing (QE) or stimulus distort its signal.

- Exergy (Joules): Cannot be printed; it must be generated, implying a physical constraint.

The Space Age Failure

Why did we stop going to the Moon? Because we paid for it in Money.

- As we printed money to pay for welfare/war in the 1970s, the "cost" of Apollo skyrocketed (Inflation).

- If we had priced Apollo in Exergy (Joules), the cost would have remained constant (or fallen as tech improved).

Verdict: Money allows society to lie to itself about what it can afford. Physics (Exergy) forces honesty.

III. The "Hedonic Distortion" (Pricing Waste)

Money is value-neutral. It thinks a $100 pair of digital sneakers is "worth" the same as $100 of Fusion Research.

- Money: "Both generated $100 of GDP. They are equal."

- Physics: "False."

- The Sneakers consumed low-entropy energy and turned it into high-entropy waste (status signaling). Net Negative.

- The Fusion Research consumed energy to create a mechanism for infinite future energy. Net Positive.

The Distortion: In a money economy, the Hedonist bids up the price of trivialities (status goods), sucking resources away from the Architect. In an Exergy economy, the "Entropy Tax" punishes the waste. It makes the digital sneakers "expensive" (in terms of social credit) because they waste energy without building capacity.

IV. The "Arbitrage" of Time

As noted in the previous section, Time is also a bad metric because it treats all hours as equal.

- Money: Pays a human $15/hour to dig a hole. Pays a robot $0.50/hour to dig the same hole.

- The Glitch: This encourages the market to devalue physical reality. We stop building things (atoms) because "software margins" (bits) are higher in dollar terms.

This leads to the "Great Stagnation": We have amazing iPhones (bits) but our bridges are falling down (atoms).

Why We Switch

We switch because Money is a tool for rationing Scarcity, while Exergy is a tool for managing Capacity.

- Money asks: "Do you have enough cash to buy this?"

- Exergy asks: "Does the planet have enough energy to build this?"

In the 20th Century, the limit was Cash (Capital). In the 21st Century (Liquid Labor), the limit is Physics (Energy/Matter).

We stop using Money for the same reason a pilot stops looking out the window and starts using instruments when flying at Mach 3. The old sensors (Prices) are too slow and inaccurate for the speed of the new economy.

THE PHYSICS-BASED CURRENCY: FROM TIME TO EXERGY

A common objection is that “time” already measures labor. The key issue is that clock time is a sloppy proxy. A robot sitting idle for one hour and a robot lifting steel beams for one hour both “cost” one hour of time, but their Thermodynamic Cost is vastly different.

I. The Flaw: Why "Clock Time" is a Fake Metric

Human Economy: Time works as a metric because human biological energy output is roughly constant (≈ 100 Watts). One hour of a human digging a ditch is a predictable caloric burn.

Robotic Economy: Output is variable.

- Robot A (Micro-assembler): Consumes 50 Watts.

- Robot B (Heavy Lifter): Consumes 5,000 Watts.

Arbitrage Opportunity: Pricing both robots at "1 Hour" creates an arbitrage opportunity that destroys the economy. A "Hedonist" rents 1,000 Heavy Lifters for the same "Time Price" as 1,000 Micro-assemblers, bankrupting the energy grid.

The Correction: We must convert "Time" into "Thermodynamic Work."

II. The Superior Metric: The "Exergy-Hour" (X)

We stop counting "Seconds." We start counting Exergy (Useful Energy available to do work).

The Governing Equation of Value (V): Instead of V = Wage × Time, the value of any good or service is the sum of the Energy used to create it and the Matter degraded in the process.

P(t) = Power (kW) - Energyδwear(t) · M = Material Entropy

Where:

- P(t): The instantaneous power draw (Energy).

- δwear: The depreciation rate of the robot (Matter). Every time a robot moves a joint, it loses microscopic amounts of steel/lubricant (Entropy).

- M: The replacement cost of the machine (Capital Stock).

The New Unit: 1 X (Exergy Unit) = The economic value of 1 kWh of Energy applied through High-Precision Actuation.

III. Pricing "Matter" as "Frozen Energy"

One might ask whether this framework prices in materials. It does.

In this framework, we treat Matter as Frozen Energy.

- Building a steel beam requires Iron Ore + Energy.

- Producing the Iron Ore requires Mining Robot Time + Energy.

The Recursion: Ultimately, the cost of every physical object tracks back to the Energy required to extract, refine, and shape it.

Price of a House: Not determined by "Real Estate Market Dynamics" (speculation), but by the Sum of Exergy (X) required to mine the concrete, smelt the steel, and assemble the bricks.

The "Matter Tax": If the Hedonist buys a new VR headset:

- They pay for the Energy to run the factory (Xenergy).

- They pay for the Entropy of the robots that built it (Xwear).

- They pay for the Material Opportunity Cost of the rare earth metals (Xmatter).

This effectively "prices in" the Earth.

IV. The "Thermodynamic Yield" Curve

How does this affect the Architect vs. the Hedonist?

We introduce a Scalar of Complexity (Ω). Not all Joules are equal. A Joule used to heat a swimming pool (High Entropy) is worth less than a Joule used to compute a Fusion reaction (Low Entropy).

The Pricing Modifier:

Where:

- Ω ≈ 0 (Heat/Motion): Heating, basic transport. Cheap.

- Ω > 1 (Intelligence/Precision): Nanomanufacturing, AI training, Surgery. Expensive.

The Result:

- The Hedonist: Wants to heat their pool. Ω is low. The price is just raw energy.

- The Architect: Wants to build a Quantum Computer. Ω is high. The price is higher because they are consuming "Computational Order," not just electricity.

V. The Post-Time Definition

Redefines "Time" not as the ticking of a clock, but as "The Rate of Entropy Reversal."

The Definition: Currency is a claim on Negentropy. It measures the capacity to impose Order (Goods/Services) on Chaos (Raw Materials) using Energy.

How to communicate this: Don't tell people "We tax your energy," but rather "We price the Universe accurately."

- Old World (Money): Price was a guess based on supply/demand and speculation.

- New World (Exergy): Price is a physical fact, the exact amount of Energy and Matter required to exist.

This creates a “Physics-Based Currency” that cannot be debased by printing money, because Joules cannot be printed.

BITCOIN: THE BRIDGE PROTOCOL

This is the critical intersection of Thermodynamics and Finance. In the 'Liquid Labor' framework, Bitcoin is not just 'digital gold.' It is the first crude prototype of an Exergy Currency.

While fiat money is based on Authority (government decree), and the Exergy Standard is based on Physics (Joules), Bitcoin acts as the Bridge Protocol. It is 'Proof of Energy.' Wwhere Bitcoin fits in the Time Bank economy.

I. Bitcoin as "Frozen Energy" (The Physics Link)

The key issue is why we don’t just use money. In this thesis, money is a “fake map” because it can be printed costlessly. Bitcoin solves the “Printer Problem” by tying currency creation directly to Physics through Proof-of-Work (PoW).

- The Mechanism: Minting a Bitcoin requires “burning” Energy (Joules) and computing SHA-256 hashes (Information).

- The Result: A Bitcoin is a “Battery of Value,” representing a verifiable expenditure of past energy.

- The Alignment: Bitcoin is the “Native Currency of the Exergy Standard,” the only asset class that respects the laws of thermodynamics (it cannot be created out of thin air; work must be performed).

Verdict: In a robot-run society (where robots run on energy), the currency must be energy-derivative. Bitcoin is the first successful implementation of this.

II. The Deflationary Hedge (The "Jeff Booth" Thesis)

The Liquid Labor thesis predicts massive Deflation (Technological Abundance).

- Fiat Reality: In a deflationary world, Central Banks panic and print money to force inflation, which "steals your purchasing power to subsidize the debt system."

- Bitcoin Reality: Bitcoin has a fixed supply cap (21M) and cannot be inflated.

- If robots make housing/food 50% cheaper, holding Bitcoin doubles purchasing power.

- Bitcoin allows holders to capture the Efficiency Dividend of the robots.

The Role: Bitcoin acts as the "Equity of the Machine Age," a bet that the cost of the physical world will collapse against a fixed mathematical constant.

III. The Currency of Autonomous Agents (M2M Economy)

Robots do not have bank accounts. They cannot pass KYC (Know Your Customer) checks at JPMorgan.

- The Friction: If a delivery drone needs to pay a charging station for electricity, it cannot use a credit card.

- A Solution: Bitcoin (and the Lightning Network) allows for Trustless Micropayments, but perhaps something with better fundamentals will emerge, such as the Solana blockchain network.

The "Liquid Labor" Flow:

- Robot A performs a task (Liquid Labor).

- Robot A gets paid in Satoshis (Streaming Money).

- Robot A pays for its own Energy (Exergy) in Satoshis.

Because Bitcoin is purely code, it is the only currency compatible with a fully automated, Machine-to-Machine (M2M) economy. It allows the Time Bank to operate without human bankers.

IV. The "Energy Wall" Synergies

Critically, Bitcoin solves a major problem for the Architect (Energy Infrastructure).

- The Problem: Building massive power plants (for Space/Industry) is risky. If demand dips, the operator loses money. This is the “Stranded Energy” problem.

- The Bitcoin Fix: Bitcoin miners act as the 'Buyer of Last Resort' for energy.

- If the grid has surplus power (e.g., sunny day, low industrial load), miners buy it instantly to hash.

- This sets a Price Floor for energy, making it profitable to build massive 100-Terawatt grids that the Architect needs for the space program.

The Symbiosis: Bitcoin effectively subsidizes the construction of the energy grid required for the Robotic Era.

V. The "Truth Layer"

In the Exergy Standard, we need a ledger that cannot be lied to.

- Fiat: A ledger managed by politicians (Subjective).

- Bitcoin: A ledger managed by physics (Objective).

"Bitcoin is the Reserve Asset of the Exergy Economy. It proves that work was done (Energy spent)."

In this thesis, Bitcoin is positioned not as a “crypto speculative asset,” but as the “Native Protocol for Liquid Labor.”

- It creates a hard unit of account that measures the deflation robots create.

- It allows robots to own money (M2M payments).

- It monetizes the Energy Surplus needed to build the grid.

Bitcoin is the bank vault; Robots are the depositors; Energy is the currency.

THE FISCAL ARCHITECTURE: TAXATION IN A TIME-BANK ECONOMY

This is the "Fiscal Architecture" of the Liquid Labor economy. In a system where Time (Robotic Labor Hours) and Energy (Joules) are the currency, taxing "income" (fiat dollars) becomes obsolete. As marginal production costs approach zero, wages collapse, and traditional income tax revenue evaporates. To sustain the state and fund "the Architect's expansion (Space/Science)," we must shift from taxing People to taxing Physics.

I. The Core Principle: Taxing Entropy, Not Effort

The fundamental flaw of 20th-century taxation is taxing Human Effort (Income Tax). In a robot economy, the goal should be to encourage machine effort, not tax it to death, while still capturing the surplus it creates.

The New Axiom: Do not tax the creation of value (Work). Tax the consumption of finite resources (Energy, Land, and Time).

II. The 4-Tier Tax Code

I. The Actuation Levy (The "Robot-Hour" Tax)

Instead of a Payroll Tax (Social Security/Medicare) on human wages, apply an Actuation Levy on autonomous labor.

- The Mechanism: Every autonomous robot has a cryptographically verified "odometer" (Proof of Physical Work) that tracks Effective Actuation Hours.

- The Rate: A micropayment per autonomous hour generated. Example: "$0.05 per robot-hour."

- The Logic: Since robots work 24/7/365, even a tiny levy generates massive revenue.

Example: 100 Million Robots × 6,000 hours/year × $0.05 = $30 Trillion in revenue base.

Why it works: It scales perfectly with the AWN (Autonomous Workforce of the Nation). As the fleet grows, the tax base grows, funding a safety net for displaced humans.

II. The Entropy Surcharge (The "Hedonist" Tax)

We cannot allow the Hedonist to burn the entire planetary energy budget on VR simulations while the Architect tries to launch rockets.

- The Mechanism: A progressive tax on Energy Intensity.

- Tier A (Survival): Basic residential power (Ascetic level) = 0% Tax.

- Tier B (Productive): Industrial power for manufacturing/farming = Low Tax.

- Tier C (Hedonic): High-entropy consumer burns (luxury travel, massive personal compute, decorative energy) = Exponential Surcharge.

The Outcome: The Hedonist pays a premium for their lifestyle. That premium directly subsidizes the "CapEx" of the fusion grids and spaceports. The Hedonist funds the Architect.

Consider:

III. The Scarcity Rent (Land Value Tax)

Robots can print houses, but they cannot print Land. In a post-scarcity world, land becomes the only true scarce asset. Without a tax, the 'Owners of the Earth' will capture 100% of the value of the robots (Rent-Seeking).

- The Mechanism: A Georgist Land Value Tax (LVT). You tax the unimproved value of the land at 100%.

- The Logic: If robots make a building 99% cheaper to construct, the price of the house falls, but the price of the location skyrockets. By taxing the land, you capture the 'location value' for the public trust.

- Effect: This prevents a feudal aristocracy from emerging where a few people own the robot-tended estates while everyone else lives in pods.

IV. The Algorithmic Royalty (The "Data Dividend")

Human labor is used to train the robots (Tele-operations). This training data is a permanent asset.

- The Mechanism: A blockchain-based royalty.

- The Rule: If a human trains a Neural Net for a specific task (e.g., folding a shirt), that human receives a fractional royalty every time a robot autonomously performs that task in the future.

- The Result: Human labor transforms into an equity investment in a "Time Bank." An "Ascetic" individual could work for 5 years training models, then retire and live off the "residuals" generated by the robots they taught.

III. The Distribution: The "Sovereign Time Dividend"

Revenue is distributed not in traditional dollars (which are prone to inflation/deflation) but in "Capacity."

- Universal Basic Capacity (UBC): The government issues a UBC credit to every citizen.

- The Credit: Each citizen is guaranteed "2,000 kWh of Energy and 500 Robot-Hours per month."

- The Choice: This credit offers two paths:

- The Ascetic: Uses the credit to build a simple house, grow food, and read books, thereby living for free.

- The Hedonist: Spends their credit on luxuries in the first week, then must work (in high-end human services or creative roles) to earn additional credits from others.

IV. Summary

In this economy, the Tax Code is redefined as a "Thermodynamic Throttle."

- Tax the Robots (Actuation Levy): Replaces Income Tax.

- Tax the Hedonism (Entropy Surcharge): Funds Science/Space.

- Tax the Land (Scarcity Rent): Prevents Feudalism.

- Pay the People (Time Dividend): Distributed in Energy/Robot-Hours, ensuring survival for the Ascetic and providing "skin in the game" for the Hedonist.